Fast Information About Automotive Costs

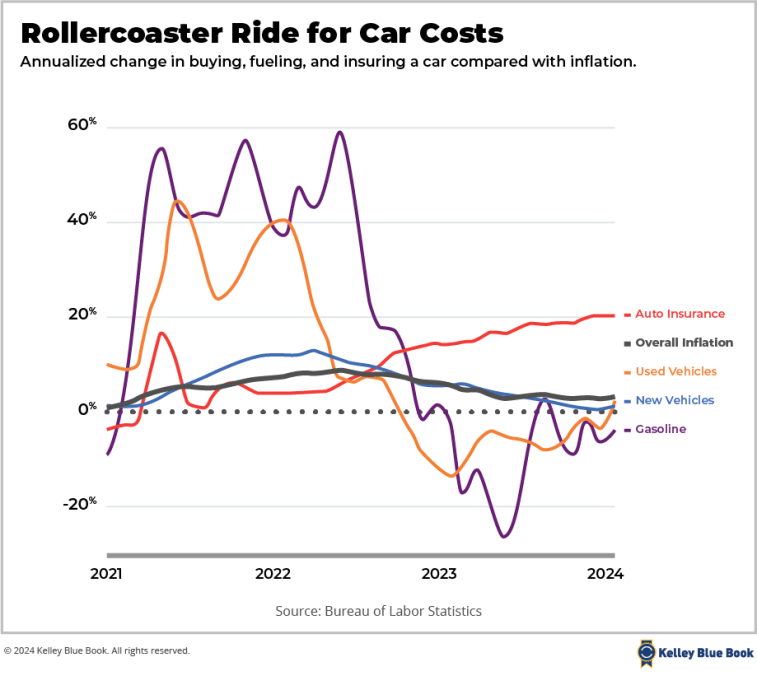

New automotive costs started falling in current months however now seem caught in impartial, at the same time as customers see plentiful supplier stock and shopping for incentives.

Within the final a number of years, automotive customers have change into accustomed to paying greater than the producer’s advised retail value (MSRP). They watched automotive costs rise with no obvious finish in sight. The scenario left many consumers scratching their heads, and the query our consultants hear most is, “When will new automotive costs drop?”

New automobile value inflation all however disappeared by the tip of 2023. That’s nice information on its face. Nonetheless, automotive costs have elevated dramatically up to now three years. Learn on for steerage if you wish to buy a automobile. We are able to equip you with the most effective data from our consultants. We dig deeper to reply issues about automotive costs.

New Automotive Costs Stay Elevated

Kelley Blue E book knowledge reveals that the typical transaction value (ATP) for brand new vehicles was $47,218 in March. Cox Automotive analysts calculate a 1% drop year-over-year. Cox Automotive is the mum or dad firm of Kelley Blue E book.

Erin Keating, govt analyst for Cox Automotive, mentioned customers shopping for new vehicles take pleasure in decrease costs “due to important provide restoration and a doubling of incentive spend in comparison with final March.” She added, “Nevertheless, it bears repeating that traditionally excessive rates of interest and related inflation, mixed with an ever-widening deficit of accessible autos at lower cost factors, will proceed to problem affordability for many automotive consumers.”

Common transaction costs stay 15.5% larger than in March 2021, because the realities of the COVID-19 pandemic appeared unending. At the moment, common transaction costs for brand new autos have been round $40,000.

Producer incentives elevated to a median of $3,100 in March. Extra on that in a bit.

Tendencies in new-vehicle affordability elements moved in assist of customers once more in March, in response to the Cox Automotive/Moody’s Analytics Car Affordability Index.

“The optimistic strikes have been assisted by the primary materials decline in rates of interest in over two years,” mentioned Cox Automotive Chief Economist Jonathan Smoke. “Nevertheless, given the move-up in charges to this point in April, that decline is more likely to be short-lived.”

Car Pricing Breakdown

- Non-luxury automobile costs: In February, automotive consumers paid a median transaction value of $44,083.

- Luxurious automobile costs: The common transaction value was $62,067 for luxurious autos. Luxurious autos make up about 18% of whole automobile gross sales.

- Electrical automobile costs: The common transaction for a brand new electrical automotive is $54,021, down 9.7% from a 12 months in the past.

“Notably, decrease EV costs have supported EV gross sales quantity within the US, notably for key Tesla fashions,” mentioned Stephanie Valdez Streaty, director of Trade Insights at Cox Automotive. “The common transaction value for a brand new EV decreased by 9% in Q1 in comparison with Q1 2023 and dropped 3.8% quarter over quarter. Nevertheless, as famous in our Q1 EV gross sales report, decrease EV costs haven’t generated appreciably larger gross sales quantity to this point.”

What Drives New Automotive Costs

- Stock availability

- Producer incentives

- Supplier reductions

- Commerce-in automobile worth

All 4 of these elements have skilled important disruptions since 2020.

New Automotive Stock Replace

Dealerships measure their inventory of recent vehicles to promote in a measurement known as “days of inventor— how lengthy it will take them to promote out of recent autos at as we speak’s gross sales tempo if the automaker stopped constructing new ones. By the beginning of April, many manufacturers’ inventories have been 46% larger than a 12 months in the past. Some producers must closely low cost autos as a consequence of a glut of provide. Nevertheless, a handful of carmakers, like Toyota, Lexus, and Honda, can’t fill all automotive orders as a consequence of an absence of stock. Days’ provide calculations embrace autos in supplier stock, in transit, or within the pipeline.

Regardless of plentiful automotive stock for many carmakers, inventory points proceed for some carmakers and explicit fashions.

Based on Erin Keating, govt analyst and senior director of financial and business perception with Cox Automotive, Toyota continues to thrive regardless of its lack of stock.

Which Automakers Have the Most Automobiles?

Cox Automotive’s evaluation of its vAuto new automotive dealership administration software program knowledge reveals that Jaguar, Dodge, Ram, Alfa Romeo, and Fiat are among the many manufacturers with days’ provide not less than twice the business common. Consumers may discover many autos in inventory at Lincoln, Jeep, Chrysler, and Volvo sellers.

Manufacturers with stock nicely beneath the business common embrace Toyota, Lexus, Honda, Land Rover, Kia, Subaru, and Cadillac.

RELATED: Is Now the Time to Purchase, Promote, or Commerce-In a Automotive?

General, the auto business stocked 72 days’ provide of autos firstly of March. Brisk gross sales drew down stock from 76 days’ final month. By comparability, automakers throughout pre-pandemic occasions in the summertime of 2019 stocked an 86-day provide of autos.

Car Incentives on the Rise

Carmakers used extra incentives to draw consumers final month than at any level since Could 2021. Based on Kelley Blue E book’s analysts, carmakers spent 6.6% of the typical transaction value on incentives, or $3,121, meant to maneuver autos. Nonetheless, that determine is low in comparison with fall 2020, when incentive ranges have been about 20% of the typical transaction value.

When automakers construct up an oversupply of vehicles, they low cost the autos to get them off supplier tons. For a number of years, carmakers and dealerships confirmed no glut of autos to promote and barely supplied reductions. Now, provide is bulking up once more, partly due to larger rates of interest on automotive loans.

Our evaluation reveals that the posh automotive phase supplied essentially the most important incentives all through final 12 months. In March, luxurious model incentives, together with for electrical vehicles, reached 7.5%, greater than twice the extent of final 12 months right now.

Store Round for the Finest Provide on Your Commerce-In

Commerce-in worth is one other issue driving automotive costs. A scarcity of used automobile inventory is pushing used automotive costs larger, giving credence to the concept that shopping for a brand new automobile is cheaper than buying a current mannequin used one. Because of this, it’s a good time to commerce in your automotive. Automakers scaled again manufacturing for a number of years after the 2008 recession, leaving the higher-mileage, older vehicles promoting for lower than $20,000 onerous to seek out now.

In different phrases, a shopper buying and selling in a 2018 Honda Civic will probably be a lot happier with the trade-in appraisal than one buying and selling in a 2021 Jeep Grand Cherokee.

Consumers must be ready to buy their trade-in round. It’s barely extra sophisticated to tug off, however promoting your outdated automotive to 1 dealership and shopping for your new automotive from a distinct one could make sense if the ultimate bill numbers work out in your favor. Use the Kelley Blue E book Prompt Money Provide software to buy your trade-in automobile at close by dealerships. Once you let the offers come to you, you may choose the most effective trade-in provide on your scenario.

It’s a Purchaser’s Marketplace for New Automobiles

The brand new automotive panorama is a purchaser’s market. Consumers heading out to buy a brand new automobile will discover many incentives to assist decrease the worth. For some manufacturers and dealerships like Toyota, Honda, and Lexus, customers ought to count on to hunt and pay extra for tougher-to-find fashions.

Toyota executives just lately instructed the Cox Automotive Trade Insights workforce that its Toyota and Lexus manufacturers are each operating too lean, closing 2023 at about 13 days’ provide, by their measure.

Cox analysts say, “On the different finish of the spectrum, pickup vehicles, led by the Ram 1500, and SUVs, led by the Ford Explorer, had the best stock among the many best-selling merchandise within the US.”

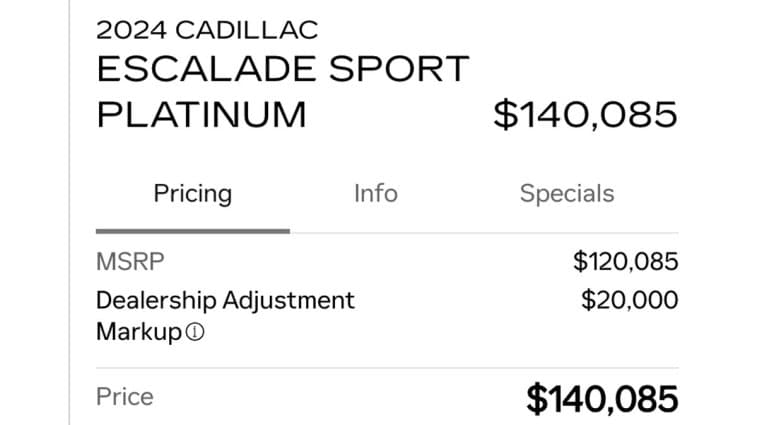

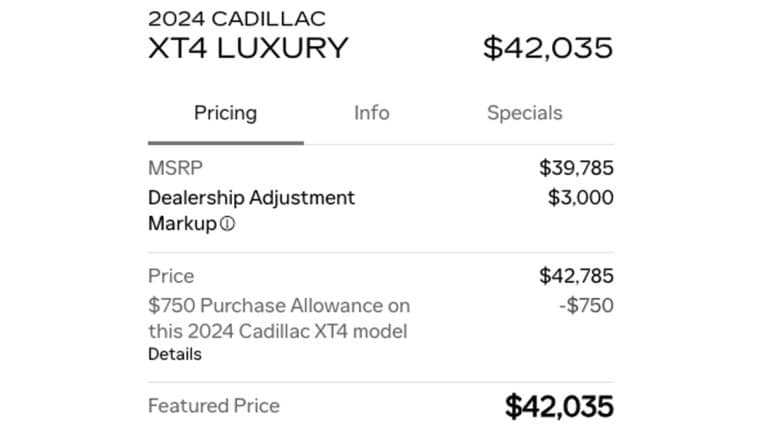

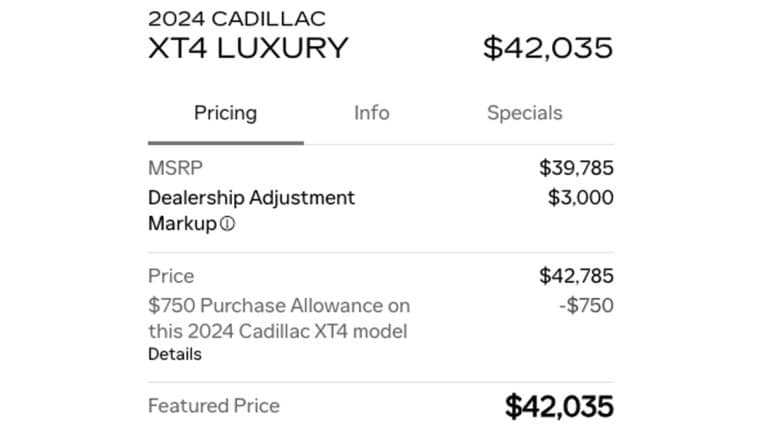

Small Variety of Automobiles Nonetheless Promote at Markup Costs

The times of paying greater than MSRP that appeared unending in the course of the COVID-19 pandemic appear primarily behind us. Most carmakers and sellers now provide ample stock and supply incentives that decrease automotive costs beneath MSRP. Nonetheless, a couple of autos stay in brief provide, and dealerships nonetheless mark up costs on these. For instance, in April, a Florida Cadillac dealership marked up a 2024 Cadillac Escalade Sport Platinum by $20,000 on their web site. The identical dealership additionally reveals a 2024 Cadillac XT4 with a $3,000 markup.

Based on Markups.org, Toyota fashions and harder-to-find new autos nonetheless promote above MSRP in New York, Texas, Hawaii, and North Carolina.

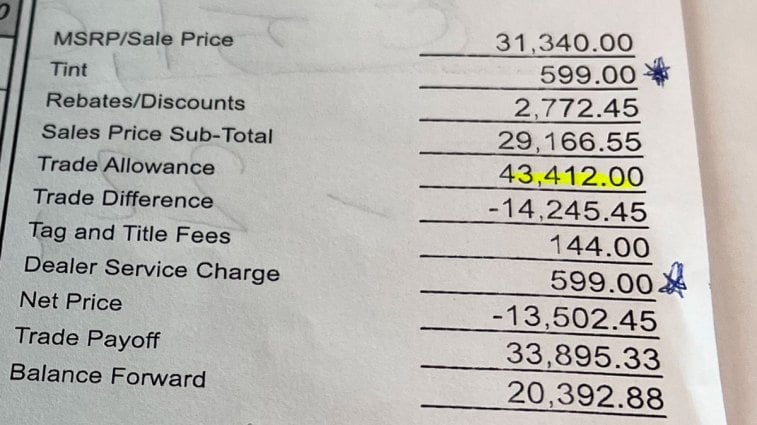

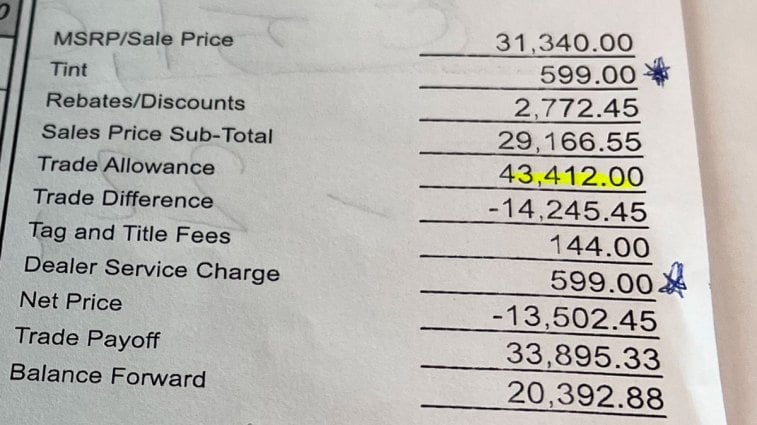

[Editor’s Note: Since shopping recently for a vehicle, I found excess fees varied at dealerships that sold vehicles such as Kia and Hyundai. One dealer charged $599 for a service charge and another $699. Another called them “doc fees.” Before you shop, understand how much those document filing fees cost for car tax, tag, and title in your state before you buy a vehicle. Those are pure markups or profit centers for the dealership. Another markup on an invoice may say “paint and fabric protection” or “window tint.” Before you sign anything, it’s wise to ask the salesperson to remove those fees if they want to sell you the car.]

Learn our article Easy methods to Keep away from Supplier Markups in 2024: Purchaser Beware to discover ways to spot and keep away from them.

The Greater Prices of Automotive Insurance coverage

Based on the Bureau of Labor Statistics, automotive insurance coverage prices jumped almost 21% in February in contrast with a 12 months earlier. Bankrate says automotive insurance coverage prices $2,545 a 12 months for full protection. Earlier than you seal the deal and signal something for a brand new automobile, examine quotes for automotive insurance coverage.

What to Anticipate: Trying Forward

However what when you desperately desire a in style automotive that’s in low provide? Now could be the second to train your endurance and wait. Final 12 months’s Federal Reserve rate of interest hikes have been aimed to rein in inflation however nonetheless make it onerous for a lot of customers to afford vehicles in the event that they want a mortgage. Based on the newest Cox Automotive analysis, the everyday new automotive mortgage rate of interest was a median of 9.6%. Car affordability is bettering, however the second half of 2024 will look higher for automotive customers. Moreover, any rate of interest minimize, if one comes, may assist affordability.

For now, automotive customers should stay versatile and search for offers. The most effective deal will not be for the automotive you thought you’d purchase.

Editor’s Observe: This text has been up to date for accuracy because it was initially revealed. Sean Tucker contributed to this report.